The new tool is “very straightforward, and likely much faster, than requiring non-filers to fill out and submit a tax form,” said Erica York, an economist at the Tax Foundation. They won’t have to provide any income information. WASHINGTON (AP) More than 9 million people and families who did not receive their advance child tax credit checks, stimulus payments and other tax rebates will soon get a letter from the IRS to. Instead, it created an online tool that asks for basic information including names, date of births, and Social Security numbers for the person filing and his or her dependents. Generally, these are individuals who did not earn more than $12,200 last year or married couples who did not earn more than $24,400.īut they won’t have to file a whole new form, as earlier guidance from the IRS suggested. There are millions of low-income people who are not normally required to file tax returns that will have to take some action before receiving their stimulus money.

However, taxpayers won’t be able to update their bank information once the payment is already scheduled for delivery, and it won’t allow you to update bank information already on file, the Treasury Department said.

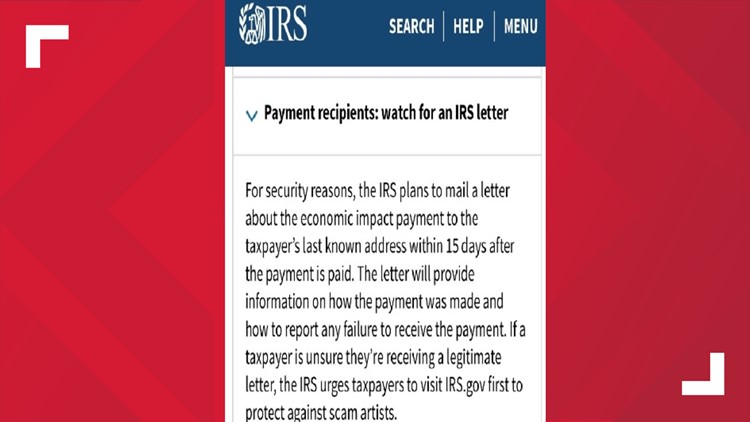

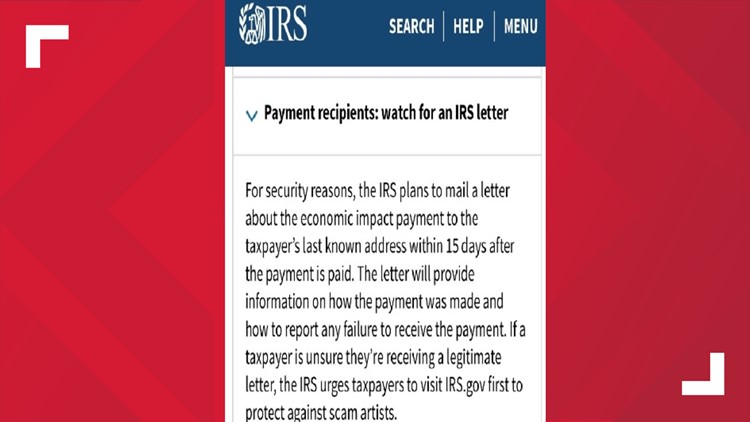

Still, the Treasury Department has said that “a large majority of eligible Americans” will receive the payments, which were authorized under the $2.2 trillion congressional coronavirus relief plan in March, by April 24. Those who haven’t been required to file a return during the past two years may have to submit some information online before receiving the payment. Taxpayers who haven’t authorized a direct deposit could be waiting weeks for a check in the mail - though they can update their bank informationusing Treasury’s new web portal, which is set to go live this week. Social Security recipients will also automatically receive their payments, even if they haven’t filed a return.īut there are tens of millions of people that don’t fall into those categories. Within that group, the agency is starting with people with the lowest incomes.

Look at the numbers on the bottom of your checks: the routing number will be the first 9 digits, followed by your 13 digit ACH/MICR number.ĭon't have Online or Mobile banking yet? Sign up for Online and Mobile Banking today to securely access your Orlando Credit Union accounts and check on your account history, transactions, make bill payments, manage your money, make mobile deposits and much more.The first payments will go to those who’ve already filed their 2018 or 2019 tax returns and authorized the Internal Revenue Service to make a direct deposit if they were due a refund. Login to Online banking or Mobile Banking and click on your "Account History" and "Details". All you need is your ACH/MICR number and a routing number. Interested in setting up direct deposit into your Orlando Credit Union account? Set up your payroll, government deposits and automatic payments to come directly to and from your Orlando Credit Union account. Enter your financial institution information if you don’t have your payment yet and want to set up direct deposit. The Internal Revenue Service, also known as the IRS, was established in 1862. Confirm your payment type: direct deposit or check. To get more answers on what to do and when to expect your stimulus checks please refer to the following IRS link: Your stimulus payment will be available in your account on the effective payment date set by the depositing entity (IRS). Please note: Orlando Credit Union does not have specific information on when to expect your stimulus check. Login to Online Banking or Mobile banking to view your account history (deposits and withdrawals) and set up eAlerts to text or email you when your deposit has been made. If you currently receive your tax return or make your tax payments via ACH through your Orlando Credit Union account you can easily check your deposit. The IRS emphasizes that there is no action required by eligible individuals to receive this second payment. IRS announced the official payment date of January 4, 2021. Initial direct deposit payments have begun to arrive and may show as pending or as provisional payment in your bank account before the official payment date. The IRS has started delivering the second round of of Economic Impact Payments – referred to as “stimulus checks”. There were two Golden State Stimulus payments (GSS 1 and GSS 2) issued throughout 2020, 2021, and 2022.

0 kommentar(er)

0 kommentar(er)